wells fargo class action lawsuit payout

Wells Fargo will establish a settlement fund Settlement Fund totaling 4500000000 to pay. The Wells Fargo CIPA Class Action was filed by the complainant CS Wang Associate alleging that Wells Fargo and companies that work for them have recorded.

Nyc Won T Open Wells Fargo Accounts Over Racial Disparities Advisorhub

The Wells Fargo overdraft lawsuit payout 2016 was the result of a long court battle.

. Wells Fargo CPI Class Action Settlement. And 4 any Service Awards to the Class. These companies have agreed to settlements in a larger class action alleging that a number of banks and other entities violated federal antitrust laws by imposing restraints that.

According to the latest reports Wells Fargo and a company working for them named International Payment Services LLC have agreed to pay 28 million to settle the case brought up against them. Luckily this is not as difficult as it sounds. April 25 2022 711 PM 2 min read.

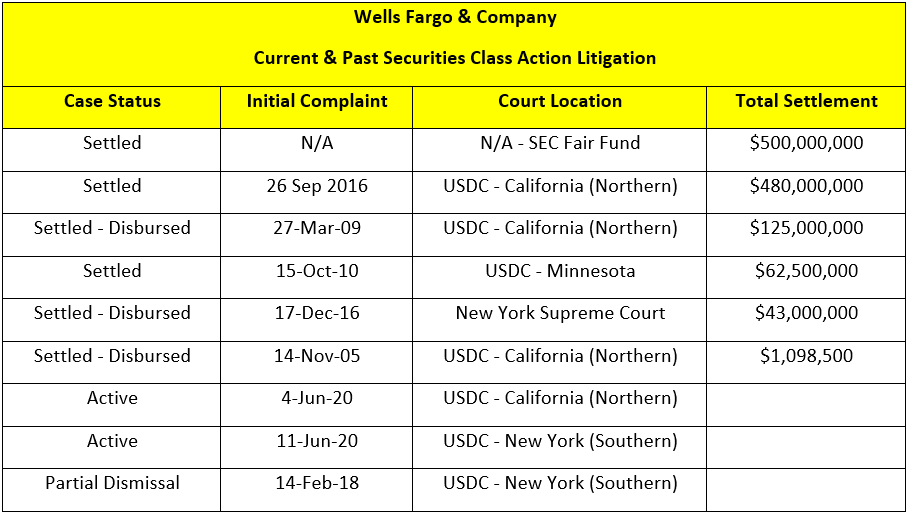

In re Wells Fargo Collateral Protection Insurance Litigation Case No. The Wells Fargo lawsuit resolves claims of fraudulent activities involving unauthorized accounts forged signatures and unauthorized services. A settlement deal with the Financial Industry Regulatory Authority has settled class action claims made by Wells Fargo.

Lead plaintiff Armando Herrera had alleged Wells Fargo collected the entire amount of the loan including the cost of the GAP. A class action lawsuit alleges that banking giant Wells Fargo discriminates against African American borrowers at all stages of the home loan process. Under the terms of the settlement agreement Class Members will be automatically entered into the settlement and receive a share of 13575 million.

The lawsuit also alleges that Wells Fargo knew of the error. On Class Action Lawsuit Against Wells Fargo. In the end Wells Fargo agreed to pay 142 million to the affected parties.

Under the SettlementPDF Defendants are distributing at least3935 million to Class Members pursuant to an Allocation PlanPDFand Distribution PlanPDF. Kristi BlokhinShutterstock Wells Fargo will pay 500 million to end a class action lawsuit refunding US. Henry Umeana is an IT professional with a sterling credit score and he had down payment money ready to purchase a home but he said there was.

If you want to remain part of the class after receiving a wells Fargo lawsuit payout you must complete a Claim Form by March 21 2022. Wells Fargo has agreed to pay 2 million to end claims it did not properly pay its home mortgage consultants and other employees. The Wells Fargo lawsuit filings follow claims of the bank unfairly repossessing property customers receiving mortgage forbearances they didnt ask for.

The financial corporation has found itself facing consumer backlash regarding alleged unfair operations of the bank potential unethical practices and more which have resulted in a range of class action lawsuits being filed. Wells Fargo to Pay 2M to Settle Class Action Lawsuit over Wage Violations. The banks overdraft policy was found to be unconstitutional under federal law.

If you are not a part of the class you may have to withdraw your Claim Form before March 21 2022. Welcome to the Informational Website for the Wells Fargo CPI Class Action Settlement. JPMorgan Chase Wells Fargo and Bank of America have agreed to pay 67 million to settle claims that they participated in an unlawful agreement that raised fees for customers who withdrew cash from bank ATMs using a card issued by a different financial institution.

Plaintiffs Reply In Support of Motions for Final Approval of Class Action Settlement and Attorneys Fees and Brief of Amicus Curiae PDF Court Orders. The company has agreed to pay 3 billion to resolve the claims. The suit was filed in May 2015.

A federal judge in San Francisco has given final approval to a 480 million deal that settles a shareholder class-action lawsuit against Wells Fargo over the banks unauthorized accounts scandal. This is a 67 million partial settlement by defendants JPMorgan Chase Co Wells Fargo Co Wells Fargo Bank Bank of America NA and Bank of America Corporation. The class action lawsuit we filed alleges that Wells Fargo failed to implement and maintain the proper software and protocols to correctly determine whether a mortgage modification was required under federal regulations.

A class-action lawsuit against Wells Fargo is currently underway but the allegations are complex and have been the subject of many recent news reports. The settlement benefits individuals who had a credit card account direct auto account home equity line of credit account or personal line account with Wells Fargo that was charged off meaning the grantor wrote. Allocation PlanPDFpayments are being issued and mailed directly by Wells Fargo on a rolling basis.

3 the Fee and Expense Awards to Class Counsel approved by the Court. 28th of March 2017 Wells Fargo agreed to shell out 110 million as a class action settlement for the class action lawsuits that accused them of registering customers for accounts they didnt consent to and never knew about. June 10 2021.

Wells Fargo Loan Modification Error Caused By Wells Fargos Negligence. The company has since apologized and resolved the cases. The lawsuit against Wells Fargo in s recent decision to waive fees for many account holders was resolved last week without any major penalties being levied.

In the end the company was forced to reimburse overdraft victims 203 million in refunds. Nonetheless this is a common mistake made by many class members. As a result the bank was ordered to pay out more than 200 million to victims of overdrafts.

Wells Fargo the nations fourth-largest bank agreed Friday to pay a 3 billion fine to settle a civil lawsuit and resolve a criminal prosecution. Ultimately Wells Fargo denied the class action lawsuits allegations but agreed to pay 185 million to settle the dispute. The bank has agreed to pay 185 million to resolve the allegations.

Consumers who paid off their car loans early and paid what they say were improper GAP insurance fees. Some of the claims include high-pressure sales tactics forged signatures and unauthorized account opening. 1 the Approved Claims for GAP Refunds to the Non-Statutory Subclass Members.

This decision however left many frustrated because it is only now after the resolution that an actual lawsuit can be filed. Wells Fargo will pay 3 million as part of a settlement resolving a class action lawsuit that claimed the bank mishandled bankruptcy credit reporting. 2 the 500 Additional Compensation payments to the Statutory Subclass Members.

The settlement includes 500 million in investors money.

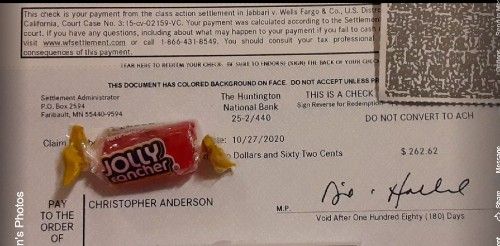

Four Settlement Checks In The Mail Top Class Actions

A Black Homeowner Is Suing Wells Fargo Claiming Discrimination The New York Times

Wells Fargo Bankruptcy Credit Reporting 3m Class Action Settlement Top Class Actions

Wells Fargo Foodstate Settlement Checks In The Mail Top Class Actions

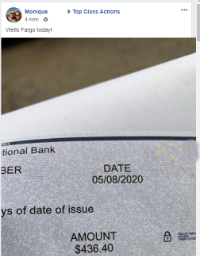

Investors Closer To 500 Million Payout From Wells Fargo Settlement

Johnson Burgee S Taut Sliced Wells Fargo Center Denver 1983 Building Skyscraper Future City

How To Get Your Piece Of The Wells Fargo Banking Scandal Settlement Bankrate Com

Wells Fargo Pays 12m For Wrongly Denying Mortgage Modifications Housingwire

How To Get Your Piece Of The Wells Fargo Banking Scandal Settlement

28m Wells Fargo Settlement Resolves Call Recording Claims Top Class Actions

Wells Fargo Finds Another 1 4m Fake Accounts Will Refund Another 2 8m Wells Fargo Account Wells Fargo Fargo

How To Get Your Piece Of The Wells Fargo Banking Scandal Settlement Bankrate Com

Wells Fargo Fake Account Lawsuit Settles For 110 Million Fortune

Keller Rohrback L L P Wells Fargo Agrees To Pay 110 Million To Resolve Consumers Class Action Lawsuit About Unauthorized Accounts Keller Rohrback

Troy Harlow Has Always Made Sure To Pay His Mortgage On Time Wells Fargo Had Other Plans For Him

Wells Fargo Account Fraud Scandal Wikiwand

Wells Fargo Reaches 3 Billion Settlement Over Fake Accounts Scandal The Washington Post

Wells Fargo Refuses Black Female Judge In Class Action Racial Discrimination Case

Wells Fargo Unauthorized Accounts Class Action Settlement Top Class Actions